The Truth About Market Making in Crypto: 5 Myths Busted

5 minutes

5 minutes

Market making is a critical component in the cryptocurrency ecosystem, ensuring liquidity and price stability across exchanges. Yet, several misconceptions persist, preventing many from fully leveraging its benefits. Whether you’re an investor, a token project lead, or part of a crypto exchange, understanding the truth about market making can significantly impact your profitability and strategic decisions.

In this post, we will debunk five common myths about market making that could be limiting your success in the crypto sphere. We’ll explore why these myths exist, how they can negatively affect your bottom line, and what you can do to correct course. Let’s get started!

Myth 1: Market Making is Only for Large Exchanges or Big Tokens

Many believe that market making is an exclusive strategy reserved for large exchanges or well-established tokens. This myth leads smaller exchanges and new token projects to shy away from implementing market-making services, thinking they are out of reach or unnecessary. However, this belief couldn’t be further from the truth. Market making is vital for all crypto entities, regardless of size.

Without market makers, smaller players often struggle with liquidity, leading to poor user experiences and lower trading volumes. This lack of liquidity can deter traders, ultimately costing you potential revenue. Market makers like Gravity Team offer scalable solutions that provide liquidity for projects of any size, ensuring that even smaller exchanges can benefit from increased trading activity.

By believing that market making isn’t necessary, you may be missing out on crucial opportunities to attract and retain traders. Instead, consider how partnering with a market maker can enhance your platform’s liquidity and improve overall user experience.

Myth 2: Market Makers Manipulate Prices to Make a Profit

A widespread misconception is that market makers manipulate prices to their advantage. However, their primary role is to maintain liquidity and ensure smooth, stable markets. Fearing manipulation, many exchanges and projects avoid market makers, leading to volatile, unreliable trading environments.

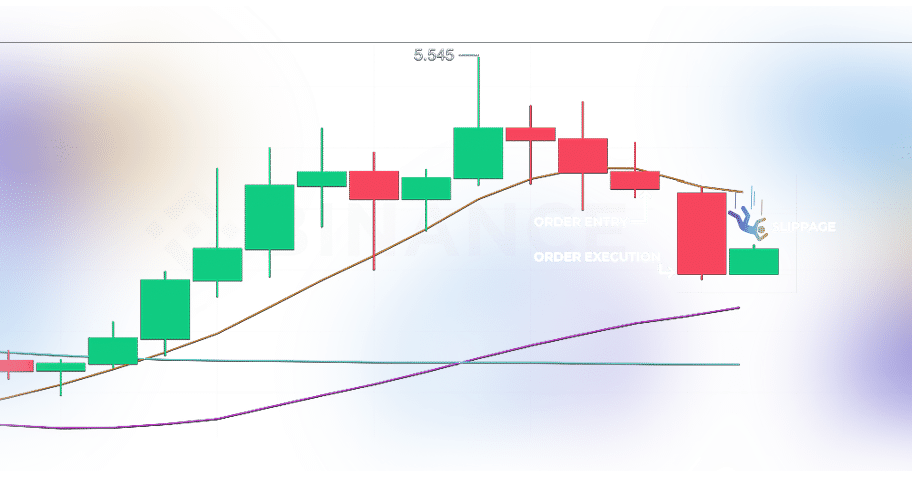

Price volatility can result in slippage and large spreads, making it expensive for traders to buy and sell. This environment drives away trading volume, reducing profitability for exchanges and token projects. In reality, market makers create tighter bid-ask spreads and reduce slippage, which in turn increases trading activity.

Market makers like Gravity Team work to foster a healthy trading environment by ensuring liquidity and preventing extreme price fluctuations. By choosing a reputable market maker, you can dispel fears of manipulation and benefit from increased trading volumes and satisfied traders.

Myth 3: Market Making is Too Expensive for My Project

Cost concerns often deter projects from utilizing market-making services. Many assume these services are prohibitively expensive, preventing them from accessing the liquidity needed for success. However, this perception is inaccurate, and avoiding market makers for cost reasons can lead to poor liquidity and decreased interest from traders.

Poor liquidity results in low trading volumes and makes it harder for tokens to get listed on top exchanges. Market makers like Gravity Team offer flexible pricing models tailored to fit the size and needs of your project. By incorporating market-making services within your budget, you can drive profitability and enhance liquidity without breaking the bank.

Understanding the true cost and benefit of market making can lead to better financial outcomes. Don’t let misconceptions about expense prevent you from accessing the liquidity your project needs to thrive.

Myth 4: Market Makers Aren’t Necessary if My Token Has High Trading Volume

Another myth is that market makers aren’t needed for tokens with high trading volumes. Yet, even tokens with substantial volume can suffer from liquidity shortages during peak trading times or market downturns. High volume doesn’t always equate to deep liquidity, and without a market maker, large trades can cause price slippage, impacting the trading experience.

Institutional traders and whales may avoid exchanges or tokens lacking reliable liquidity, costing you significant trading activity. Market makers like Gravity Team provide liquidity solutions that ensure deep order books and smooth trading, even in high-volume environments.

By recognizing that high volume doesn’t negate the need for liquidity support, you can maintain a competitive edge and keep large traders engaged with your platform.

Myth 5: Market Making is Only About Liquidity

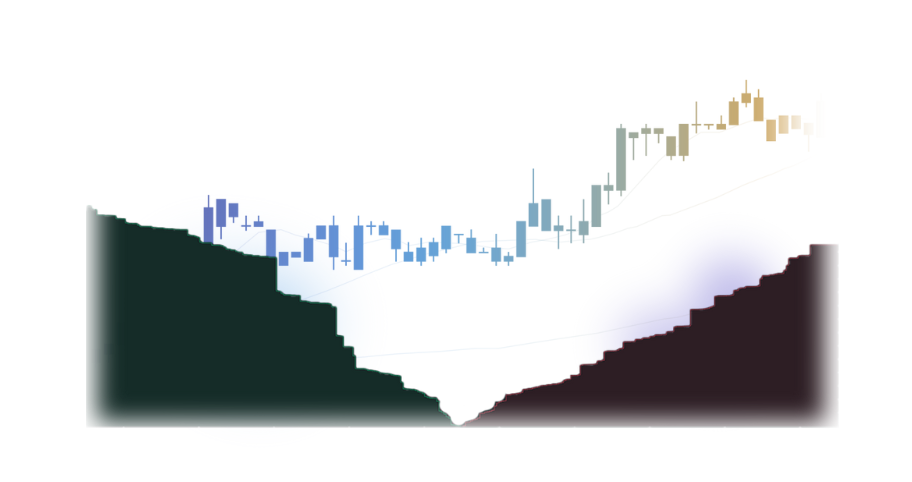

While liquidity is a key function of market making, it’s not the only benefit. Market making also plays a crucial role in price stability and market confidence. Without consistent liquidity and price stability, markets experience extreme volatility, scaring away long-term investors and damaging credibility.

Lack of price stability causes drastic fluctuations, discouraging investment and long-term holding. This results in lost market credibility and diminished investor trust. By working with market makers like Gravity Team, you can ensure stable, predictable pricing, which builds investor confidence and encourages more trading.

Market making is not just about liquidity—it’s about fostering a stable, trustworthy trading environment that attracts and retains investors.

The True Cost of Believing These Myths

Believing in these myths can lead to lost trading volume, higher slippage, and a poor user experience. Avoiding market makers based on misconceptions directly impacts revenue streams for exchanges and token projects. Many of these myths stem from misunderstandings about the roles and benefits of market makers.

By recognizing the realities of market making, you can make informed decisions that enhance liquidity, improve user experiences, and ultimately boost profitability. Don’t allow myths to dictate your approach to market making—embrace the truth and see the financial benefits unfold.

Why Working with a Professional Market Maker Like Gravity Team Pays Off

Partnering with a professional market maker like Gravity Team provides long-term financial benefits. Our expertise ensures tighter spreads, reduced slippage, and better market stability. Over the years, Gravity Team has helped clients improve liquidity and revenue through tailored solutions and strategic insights.

Success stories abound, with companies like Binance awarding Gravity Team as “Top Liquidity Contributor of 2024”, and others testifying to the positive impact of Gravity Team’s market-making services. By engaging with a seasoned market maker, you can transform your trading environment and elevate your project’s success.

Consider reaching out to Gravity Team to discuss how debunking myths and leveraging professional market-making services can boost your bottom line.

Conclusion

Believing in market-making myths is costing you money. The right market maker can turn this around, offering liquidity, stability, and increased trading activity that drives profitability. Ready to stop losing money to myths?

Let’s talk about how Gravity Team can help your crypto exchange or token project succeed.

Contact Us

We are always open to discussing new ideas. Do reach out if you are an exchange or a project looking for liquidity; an algorithmic trader or a software developer looking to improve the markets with us or just have a great idea you can’t wait to share with us!