Weekly Crypto Market Insights – 21st November

3 minutes

3 minutes

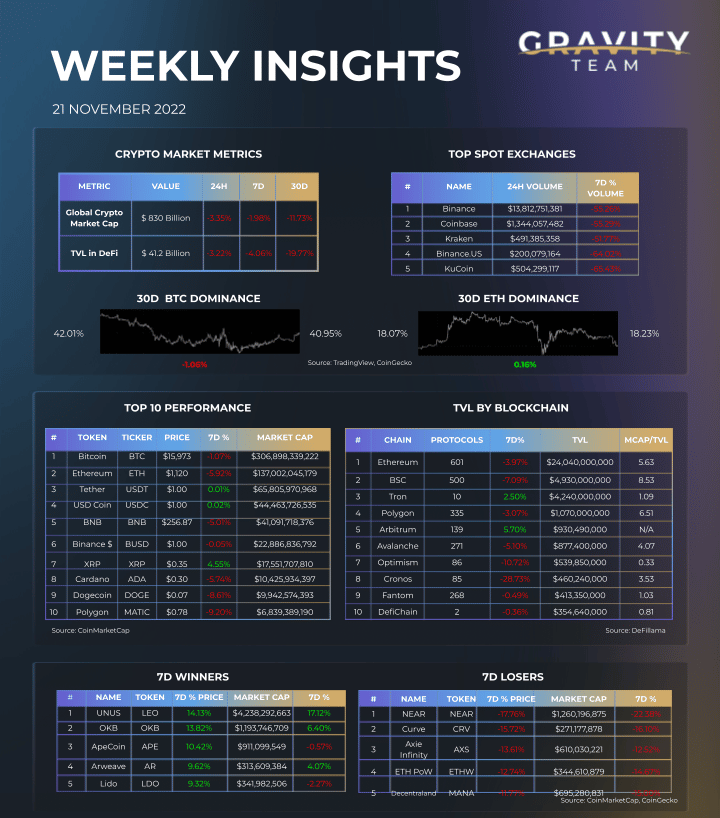

Last week the crypto market marked a slowdown and wait-and-see approach from the industry. After the many bank runs and scale-downs on crypto, it let things settle and calm down a bit, leading the global crypto market to shrink by just -3.35%. As expected, exchange trading volumes were down following a volatile week. Bitcoin went under the $16k mark, and ETH is now trading at $1,120.

The most noteworthy news are mostly around FTX collapse and contagion (creditors are awaiting $3.1 billion, Alameda’s secret exemption from liquidity protocol, etc.); a few crypto hedge funds stated their (optimistic) opinion about crypto; Trump is back on Twitter, and Bloomberg Terminal’s 50 Crypto Assets, among others.

Key Market Metrics

- Binance down by -55%

- Coinbase down by -55%

- Kraken down by -51%

- Binance.US enters the leaderboard, down by -64%

- KuCoin down by -65%

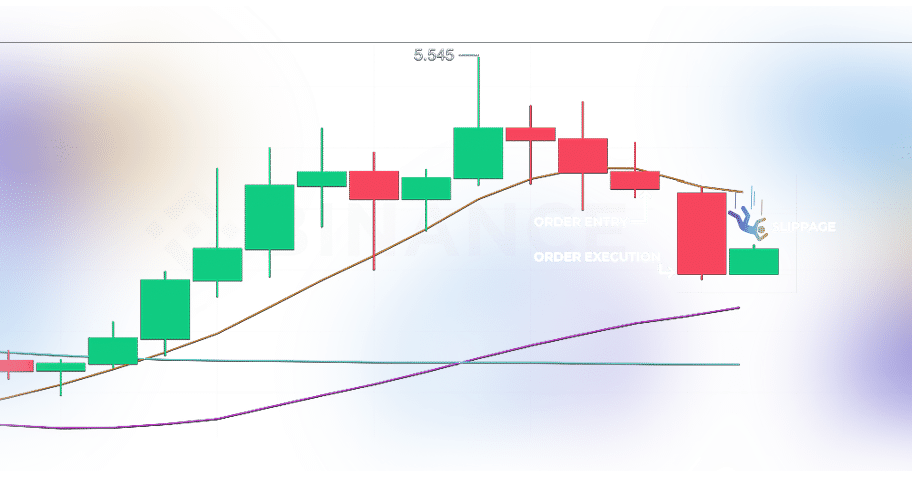

Top Gainers & Losers

Top losers were: NEAR by -17.76%, CRV by -15.72%, AXS by -13.61%, ETHW by -12.74%, and MANA by -11.77%.

Recap of the Most Noteworthy News of Past Week

- This week’s biggest crypto stories

- Last week’s brief recap by The Block

- Previously skeptical billion hedge fund manager says crypto is here to stay

- Top 50 FTX creditors await $3.1 billion payments

- After Elon’s Twitter poll at 51%, Twitter reinstates Trump account

- $138B London-based Hedge Fund to get into crypto by the end of 2022

- Stablecoin’s increased in trading volume following FTX Fraud

- Review of what happenned with the FTX hack

- Review of selection of 50 assets for Bloomberg terminal

- Crypto’s Deep Dive into the red

- Asia-based crypto investment firm’s ties with FTX

- Alameda had Secret Exemption from FTX’s Liquidation Protocols

- FTX pitch deck projections not backed by ‘viable assumptions,’ legal expert says

Contact Us

We are always open to discussing new ideas. Do reach out if you are an exchange or a project looking for liquidity; an algorithmic trader or a software developer looking to improve the markets with us or just have a great idea you can’t wait to share with us!