How to List Crypto Token on Exchanges? | Full Guide

7 minutes

7 minutes

For first timers, getting a coin listed on an exchange offers the opportunity to make your project available to a financial market full of buyers and sellers. Now, everyone from your advocates, supporters, haters and just about anyone who wants to make a quick or slow buck can now buy your token and fill up your wallet with fiat or other crypto.

For those already listed on at least one exchange, every additional exchange grants an entry into a new market full of traders and investors who could join your community and increase your crypto’s market cap and popularity.

There are a lot of benefits in getting your coin listed but the journey to get there can be a long and bumpy road..

That’s why we have put together this article to guide you through the process if you were to do it on your own.

Starting from:

- Researching & choosing the right exchanges

- Listing process: completing & submitting the paperwork

- Waiting for a response & speeding up the process

- Negotiating listing fees

- to finally launching & celebrating the launch…

- and then… ensuring your project doesn’t get unlisted due to dropped trading volumes

So let’s begin with part 1 steps 1 to 3 …

Step 1: Researching & Choosing the Right Crypto Exchanges

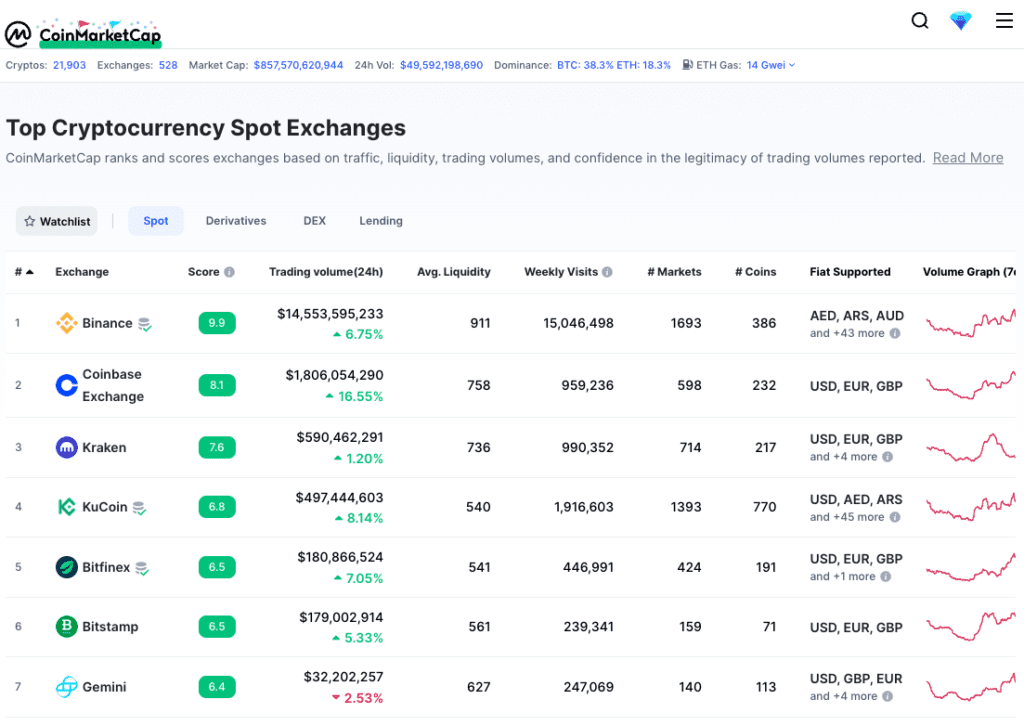

At the time of writing this, there were 528 in total and 242 ranked cryptocurrency exchanges and over 8.9k ranked and a total of 21.9k cryptocurrencies, according to CoinMarketCap. With so many exchanges out there, what criteria should you use to choose the right ones to list on?

It depends on your goals and asking your project questions, such as:

- What is the cryptocurrency exchange’s reputation?

- How safe is it to store funds for its users? Are they transparent about their proof of reserves? Can these proofs be trusted?

- How much can you afford to spend on listing fees?

- How quickly do you want to get listed?

- What is your target geographical market?

- Which exchanges support your protocol & can technically integrate on their platform?

- Is it possible to trade fiat to crypto & vice versa on this exchange?

- Does it offer spot or margin trading? How about staking?

- What volume does the exchange have & is it real and not due to wash trading?

- How is their community management & customer service?

- Do you want to your token to get listed on centralized or decentralized exchanges?

Once you answer these questions, you should have a clearer picture on what factors play a role in your decision making.

What is your timeline & budget?

For example, if you would like to make your first listing as quick as possible, you would likely go for a decentralized exchange first. Decentralized exchanges, such as Uniswap will allow you to get listed quickly and painlessly.

However, if your goal is to get listed on a top tier exchange and you don’t mind a longer process, then your next question should be “do I have a budget to spend on listing fees in excess of $100,000- $1,000,000?”

If yes, then you can go right after all of the top tier exchanges. If no such budget is available, then not all is lost. You could get your coin listed on a top tier crypto exchange, such as Kraken at no cost, or on Binance via the Launchpad/Launchpool application.

Avoiding scam & fraud

What you should watch out for is avoiding fraud and scam. One way to minimize such risk is to examine volume, online reputation and website traffic, or you could also use CoinMarketCap’s Exchange Score as a guide. The score is calculated by examining factors, such as: “Web Traffic Factor; Average Liquidity; Volume, as well as the Confidence that the volume reported by an exchange is legitimate” which is then summarized in a score from 1-10 (10 being highest).

Proof of Reserves

Another important aspect in the light of recent crypto market events is to know whether your chosen exchange(s) has audited reserves / have listed their proof of reserves in a transparent and verifiable manner (e.g. etherscan). Some exchanges currently implementing this are Kraken, Binance

Once you have gone through this analysis, make a list with your desired target exchanges, review in detail their listing requirements, and surf online for feedback on the length of and complexity of the listing process.

Step 2: Listing Process: Completing & Submitting the Paperwork

This step involves reviewing all the requirements listed on each target exchange and compiling all the information required to complete the submission process.

Listing Process: Decentralized vs Centralized Exchanges

As mentioned before, what you will quickly discover in your research is that for decentralized exchanges the listing process is fairly simple and involves less steps and formalities.

For centralized exchanges, especially the top tier ones, you can expect a ton of eligibility and legal requirements. Most of such exchanges operate in regulated territories, as well as simply want to protect their users by listing only quality projects. If you do pass their requirements and meet the eligibility criteria, going through this process is a pretty good problem to solve, congratulations!

However, please do keep in mind that for some exchanges, such as Binance, you can expect a 98% chance to not to hear from Binance after applying. Ouch!

So best to weigh in your chances & time priorities before you go through their 70+ questions application process. Although, on the other hand, if you do gather all the answers to the lengthy form, chances are that it’s all the info you will ever need to submit a listing application anywhere else.

Image credits: Binance

Typical crypto project application requirements (that range from 15-70+ questions) are as follow based on Binance, Crypto.com, Kraken and other listing application forms and recommended actions:

- Project Details: Name, Coin Ticker, Website, token address, number of holders, one sentence pitch

- Purpose, pain points, target industry and target users, project history, long term vision, detailed quarterly roadmap for next few quarters, top competitors

- Whitepaper including ICO, Management Team (plus their background) & Project Scope

- Nature of the project: currency, dApp, platform, protocol, stablecoin, DeFi, NFT, other

- Status of the project: MVP, Test Net or Main Net (& planned launch on main net)

- Signed NDA (e.g. in the case of trying to get listed on Binance)

- Token & tokenomics info: market cap, max supply, circulating supply, ERC-20 or BEP 20 standard or not, planned swaps to launch on mainnet, blockchain explorer link

- Token listing on CoinMarketCap

- Community, DAU, MAU, and links to social profiles (e.g. Twitter, Telegram, Discord, Slack, LIne, Reddit etc.), developer communities, and recent activities (e.g. bounties, hackathons, meetups etc.)

- Legal opinion produced by a top law firm on the status of the token/coin being/not being a security or another regulated financial instrument in the territory based on local legislation

- Team: core team info, previous/current project involvement, advisor info

- Legal entity review

- Security audit report conducted by 3rd party auditor (optional for some exchanges)

- Marketing activities planned post launch

- Acknowledgment that the crypto token/coin could be delisted with no refunds issued if the event happens (e.g. volume drop, misconduct)

- Partnership with a crypto market maker and liquidity provider. Many exchanges these days prefer to work with projects who can come to the exchange with a market maker

Step 3: Waiting for Application to be Reviewed

The lengthiness of the application review depends on the exchange chosen. If you would like to get your token listed on a centralized exchange, on average, you can expect to wait for 2-3 months for review, whilst for top tier exchanges, it can be even more, if you are lucky enough to get a response.

Possible outcomes

Once the preliminary assessment of the application by the exchange is completed, there can be 3 different outcomes:

1. No Response

2. Rejection

3. Request for Further Documentation

Neither the acceptance nor rejection of the listing, just the requirement of further legal documentation or technical modifications for the listing to be reached.

4. Full acceptance of the project as it is.

If the feedback is positive and the application is accepted, further technical modifications need to be done for the listing process. For example, Binance demands projects not yet listed on exchanges to be first listed on Binance DEX, which may lead to a necessary migration or swap plan to the Binance Chain. In addition, different exchanges may use different technology based on other blockchains, requiring compatible tokens to be issued.

Speeding up the review process

What greatly helps to keep the needle moving forward is introductions and connections. If you and your team are well-connected already, that’s great news, your chances of success are much higher. If not, not all is lost, you can always reach out to us and we can help you with introductions to our network of partner exchanges and crypto market making. Either way, listing and partnering with a market maker will increase your chances of (earlier) success.

We’ve covered a lot of ground and if you’ve gotten this far, congratulations, you’ve done most of the legwork already!

First published April 4th, revised on 31st November.

Contact Us

We are always open to discussing new ideas. Do reach out if you are an exchange or a project looking for liquidity; an algorithmic trader or a software developer looking to improve the markets with us or just have a great idea you can’t wait to share with us!