Crypto Projects and Adoption in Emerging Markets

More than 560 million people globally are estimated to own cryptocurrency or actively invest in crypto assets. While most crypto projects have focused on serving developed markets, the organic adoption of digital assets in emerging markets has steadily grown.

But what exactly is driving this adoption? In this article, we will explore the current state of crypto adoption in emerging markets, its potential for growth, and the key challenges that must be overcome for sustainable success.

Understanding Crypto Adoption in Emerging Markets

Emerging markets are defined as developing countries with rapid economic growth potential. Compared to developed markets, these regions often have lower average incomes, weaker currencies, and underdeveloped financial systems.

The adoption of cryptocurrencies in emerging markets has steadily increased in recent years. According to a report by Chainalysis, a blockchain data platform, emerging markets account for a significant portion of global crypto adoption.

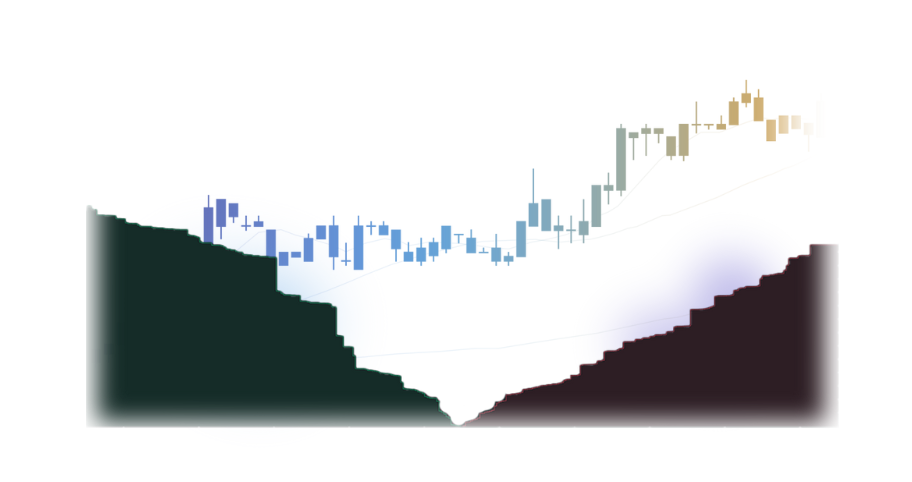

The World Bank categorizes countries into four groups based on their gross national income (GNI) per capita: high income (HI), upper middle income (UMI), lower middle income (LMI), and low income (LI). LMI countries have shown the most robust recovery in adoption since the 2021/2020 crypto bear market.

With 40% of the world’s population residing in LMI countries, the highest among all income categories, the impressive adoption of cryptocurrencies in these regions could have far-reaching implications for pushing mass adoption globally.

Countries with the Highest Crypto Adoption Rates

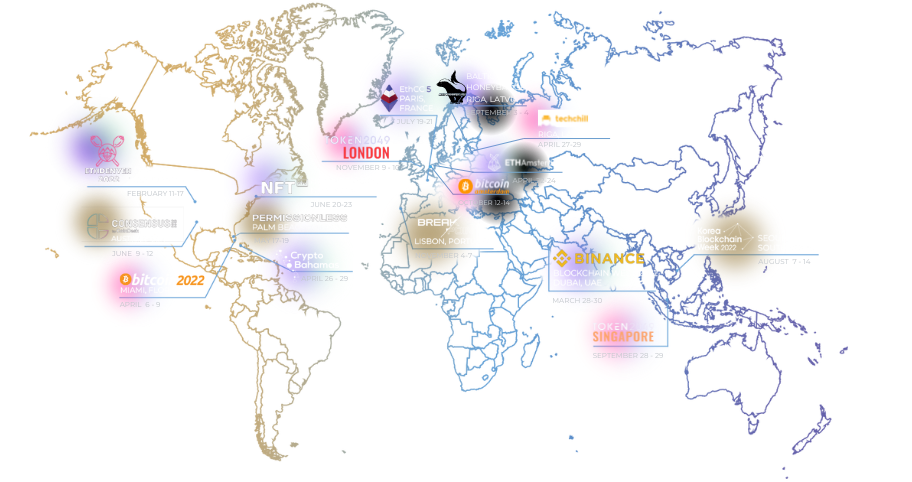

The 2023 Global Crypto Adoption Index reveals that six of the top ten countries with the highest adoption rates are from the Central & Southern Asia and Oceania (CSAO) region, making it the region with the highest overall adoption.

India tops the list, followed by Nigeria, Vietnam, and Ukraine. The United States is the only high-income country in the top five. Other CSAO countries in the top ten include Pakistan, the Philippines, and Indonesia.

India’s strong performance is driven by its high rankings in the “centralized service value received” and “DeFi value received” sub-indexes, which indicates strong activity on both centralized crypto exchanges and DeFi platforms.

Nigeria’s adoption is fueled by its large unbanked population and the need for efficient cross-border remittances. The report showed that Nigerian residents were putting a larger share of their wealth into peer-to-peer cryptocurrency transactions than residents of other countries.

Vietnam’s tech-forward youth and growing e-commerce sector have contributed to its widespread adoption. At the same time, Ukraine’s political and economic instability has made cryptocurrencies an appealing alternative to traditional financial systems.

Remittance Possibilities in Emerging Markets

Remittances are a significant contributor to the economies of many emerging markets. For example, in 2023, remittance flows increased by 3% from 2022 to reach $860 billion. India, Mexico, China, the Phillippines, and Egypt were the top five recipients of remittances in 2023.

Cryptocurrencies have the potential to revolutionize traditional remittance methods by offering cheaper and faster transactions, especially in regions with high adoption rates like CSAO. With cryptocurrency, individuals can send money across borders without needing a bank account or relying on expensive third-party services.

Cryptocurrencies can increase financial inclusion by providing access to financial services for the unbanked and underbanked populations in emerging markets. All someone needs is a smartphone and an internet connection to send cryptocurrencies to family on the other side of the world.

Moreover, with traditional remittance methods, a significant portion of money is lost in transaction fees. Cryptocurrencies eliminate this issue by offering low or even zero transaction fees, making it a more cost-effective option for individuals to send money to their loved ones.

Several successful crypto remittance projects and initiatives have emerged to address the needs of emerging markets. For example, BitPesa uses blockchain technology to facilitate cross-border payments and remittances in Africa.

The Role of Local Crypto Exchanges In Emerging Markets

People in emerging markets may find it challenging to access global crypto exchanges due to regulatory restrictions, limited internet connectivity, or language barriers. As a result, local crypto exchanges have emerged to cater specifically to these markets’ needs.

Here are the key ways in which local crypto exchanges are helping to drive adoption in emerging markets:

- Fiat On-Ramps: Many local crypto exchanges work with their governments and banks to provide fiat on-ramps. Now, individuals in these markets can easily convert their local currency to cryptocurrency and vice versa without relying on international exchanges.

- Localized Support & Education: Language barriers can significantly hinder understanding the complexities of cryptocurrencies. Local exchanges provide localized support in native languages, making it easier for individuals to navigate a new industry.

- Lower Fees: International crypto exchanges typically charge higher fees for individuals in emerging markets due to currency conversion costs and other factors. Local exchanges can often offer lower fees, making it more accessible for people in these markets to buy and sell cryptocurrencies.

- Market Understanding: Local exchanges better understand the needs and preferences of their local market. They can tailor their services, such as listing popular local coins or offering specific trading pairs, to cater to the demand in these markets.

- Regulatory Compliance: It is not always possible for an international exchange to comply with each country’s regulatory requirements. Local exchanges can often navigate and adhere to local regulations, providing users with a more secure and compliant platform.

However, local exchanges also face several challenges:

- Liquidity Issues: Local exchanges generally have lower trading volumes than their international counterparts. Some users may find it challenging to execute large trades due to insufficient liquidity, resulting in higher slippage and potential losses.

- Competition from Global Exchanges: Global exchanges often have larger user bases, more advanced features, and greater brand recognition, making it difficult for local exchanges to compete.

Despite these challenges, local exchanges remain essential to the growth of crypto ecosystems in emerging markets. By providing accessible and tailored services and complying with local regulations, they can help drive adoption in these regions.

A market-making service or liquidity provider can address the liquidity issues mentioned above. At Gravity Team, our world-class market-making services are proven to help local exchanges gain market-leading positions of up to 90% market dominance.

Local Over-the-Counter (OTC) Markets

In addition to local exchanges, over-the-counter (OTC) markets are significant in facilitating crypto adoption in emerging economies. OTC markets allow individuals to buy and sell cryptocurrencies directly with each other without the need for a centralized exchange.

This peer-to-peer trading model is critical in regions with limited access to traditional banking services or strict regulations on crypto exchanges. OTC markets also offer greater privacy for buyers and sellers, as transactions are not recorded on a public order book.

However, the peer-to-peer nature of OTC markets can make it easier for scammers to take advantage of unsuspecting users. It is essential for individuals to thoroughly research and verify their trading partners before engaging in OTC trades.

Despite these risks, OTC markets remain an important component of the crypto ecosystem in emerging markets, providing a valuable on-ramp for individuals who may otherwise be excluded from participating in the crypto economy.

Challenges for Crypto Adoption in Emerging Markets

It’s not always easy for emerging markets to embrace cryptocurrency. Let’s look at some of the challenges that may hinder adoption in these regions:

Regulatory Uncertainties

Some countries have embraced cryptocurrencies and provided clear regulatory frameworks, while others have banned or restricted their use. This patchwork of regulations can confuse crypto projects and stifle innovation in emerging markets.

India, for example, effectively banned banks from dealing with crypto businesses in 2018, only for the Supreme Court to overturn this decision in 2020. However, there are still reports of potential regulatory roadblocks, creating a climate of uncertainty for crypto projects and users.

Infrastructure and Technological Limitations

One of the most significant challenges is the lack of reliable internet connectivity in many parts of the developing world. According to the International Telecommunication Union, roughly one-third of the world’s population (2.6 billion) has no internet access.

While mobile phone adoption has grown rapidly in recent years, many individuals still rely on basic feature phones that may not be compatible with crypto wallets and dApps. Projects can tackle this by developing lightweight wallets, offline transaction capabilities, and other features that work in low-bandwidth environments.

Another critical limitation is the lack of access to traditional banking services. Many individuals in these regions do not have bank accounts, making it difficult to participate in the digital economy. Without bank accounts, people face significant barriers to converting between fiat currencies and cryptocurrencies, hindering their ability to use crypto for everyday transactions.

Addressing these complexities will require a collaborative effort between crypto projects, local governments, and international organizations to create an enabling environment for crypto adoption in emerging markets.

The Transformative Potential of Crypto in Emerging Markets

The rapid growth of crypto adoption in emerging markets highlights the transformative potential of this technology. People in these regions face unique challenges, such as high inflation rates, limited access to traditional financial services, and government corruption.

Crypto offers an alternative financial system that is decentralized, more accessible, and resistant to censorship or government interference. It also provides the potential for individuals to participate in a global economy and access services that were previously unavailable to them.

As the crypto ecosystem matures, it is crucial to recognize the significance of local exchanges and high liquidity in facilitating the seamless integration of cryptocurrencies into the financial lives of individuals in these markets.

At Gravity Team, we are dedicated to supporting the growth of crypto in emerging markets by balancing the supply and demand across global crypto markets. We deliver deep liquidity to our partner exchanges to provide the best user experience with competitive organic spreads.

Please do reach out if you are an exchange looking for liquidity or a project seeking market-making services. Together, we can harness the power of crypto to drive positive change and economic growth in emerging markets.

Contact Us

We are always open to discussing new ideas. Do reach out if you are an exchange or a project looking for liquidity; an algorithmic trader or a software developer looking to improve the markets with us or just have a great idea you can’t wait to share with us!